Opendoor is a real-estate company that I have grown to admire because they are challenging the status quo of home buying and selling. Anyone can buy or sell their home using the platform. Following is a thought exercise for a new Opendoor product to help buyers make an offer that sellers will find attractive.

Here’s a presentation to go with the writeup.

**Note: I don’t work at Opendoor. I just spent a few hours researching and writing this up**

Mission: Help buyers make an offer that sellers won’t refuse.

Goal: Design an MVP product to help buyers make attractive bids to sellers, especially in a competitive market.

North Star Metric: Bid Conversion Rate: % of offers accepted (# accepted bids / # bids).

Secondary Metric: Contract Conversion Rate: % of offers accepted that closed ( # contracts closed / # accepted bids).

My Approach

I applied first principles by talking to an Opendoor home buying advisor and loan officer, an independent real estate agent, and an in-market buyer. I then analyzed the current Opendoor buyer flow (iOS app), while researching real estate market trends, to investigate the home buyer and seller problem space. Finally, I hypothesized potential solutions for building a new product that could have an impact on Opendoor’s bid conversion rate.

What is Opendoor?

Opendoor is a web and app driven platform for home sellers and buyers. Sellers in Opendoor markets can get an instant offer (if the home meets the Opendoor criteria) from Opendoor. Think of it like CarMax for houses, except you don’t have to leave your house. Buyers can make offers on an Opendoor-owned listing, or any listing that is not on Opendoor but is in an Opendoor market. The Opendoor app helps you seamlessly navigate the buyer transaction, making the home buyer’s journey more predictable by providing help with:

Financing: Work with an Opendoor partner institution or use Opendoor underwriting (conventional and FHA loans) that comes with perks such as a 1.5% discount on the sale price, $1000 closing credit, and savings from zero processing and underwriting fees.

Search: Start your search in the Opendoor mobile or web application that allows virtual or self-driven in-person visits. Opendoor advisors can unlock some homes remotely for convenience. A buyer can also make an offer within the app should they choose to.

Agent: Buyers can work with their own agent or choose an Opendoor agent, who could be an independent partner agent or employed by Opendoor.

Education: While educating the buyer on the process, it also enables buyers to communicate with dedicated Opendoor advisors available to answer questions via in-app chat or a phone call, making the process as low-touch as preferable by the buyer.

Core Hypothesis

Home buyers and sellers would prefer a more seamless and touchless end-to-end experience driven by a real estate platform and partner they trust, without having to navigate across multiple platforms, vendors, and other real estate professionals.

Buyers will represent themselves as agents, while expert real-time support would become a value-add for education and peace of mind for the unsophisticated buyer. Gen Y, Millennials, and Gen X represent 61% of home buyers according to the 2020 National Association of Realtors report. These generations are tech savvy and will change the status quo of multi-touch processes and gatekeepers.

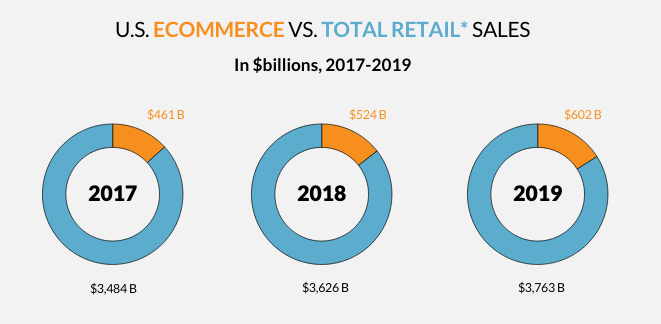

Competitive Markets

Opendoor operates in select markets (21 cities in 7 states). For this product, we will analyze markets with the lowest bid conversion and offer conversion rates in addition to the volume of closings to gauge potential impact.

Buyer Segments

Home buyers can be segmented in various ways to identify their needs.

First-time or repeat buyers: A repeat buyer may have set preferences about the agent or lending partner and is more educated about the process than an unsophisticated buyer.

Property Use: Primary home, second/vacation home or investment.

Listing Type: Opendoor property or an independent listing that is in an Opendoor market.

Funding: Cash or financed offer.

Agent: Self-serviced (buyer is the agent), looking for an agent, has an agent.

However, to better understand what forces allow one buyer group to have a winning bid versus another, we will dive deeper to consider the potential impact of the offer provided and ways in which it could have been enhanced. We will also identify opportunities for increasing the offer submission rate by examining buyers who started an offer process but did not proceed to submit their offers.

Buyer Needs

Bid: Buyers in competitive markets lack visibility and clarity on offer dynamics. That need is currently facilitated and mediated by agents who are equipped with MLS data and provide recommendations for competitive bid packages.

Experience: Buyers of all levels of experience want the upsides of controlling the process but don’t want to deal with its complexities.

Savings: Buyers would like to save on various fees in the process that they could instead invest in their new homes.

Dynamics of a Competitive Offer

In markets where there is more demand than inventory, sellers often receive multiple offers with bids that are at or above the listing price. Buyers prepare by optimizing every aspect of the offer to make bids more attractive to sellers.

Offer Bid: Aligned with available inventory, demand, and comparable to recently closed transactions.

Offer Type: Sellers often prefer an all-cash bid due to the increased likelihood of closing compared to certain financed offers. Financed offers come with varying loan statuses such as pre-qualified, pre-approved, and underwritten pre-approved.

Contingencies: These are a variable for sellers in the closing contract. Being flexible with contingencies such as inspection, appraisal, and sale of current home makes offers more attractive to sellers.

Closing Time-frame: Sellers may prefer a flexible time frame for closing.

Personal Letter: Including a personal letter increases a buyer’s chances of winning a bid, especially when all other bids are equally competitive.

Hypotheses & Potential Solutions:

Hypothesis 1: Buyers want to know how to evaluate their overall offer package based on MLS real-time data and other factors to gauge the likelihood of offer acceptance.

Hypothesis 2: Buyers will improve their offers by following Opendoor’s recommendations.

Feature 1:

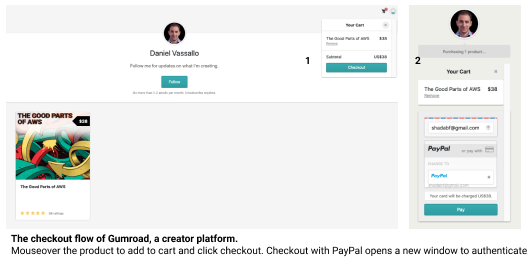

”Offer Simulator” - Opendoor shows an offer’s chances of acceptance on a scale of ‘Low-Average-High’ based on the bid, listing price, market conditions, and other factors.

When buyers enter details in the Offer Simulator, like offer amount, preferences for agent selection, how the purchase will be financed, contingencies, closing-time, and inclusion of a personal letter, they are provided with the following assessments:

(a) Chance of acceptance on a scale of Low-Average-High.

(b) List of recommendations to improve the offer’s chances of acceptance.

Hypothesis 3: Buyers want to make a competitive offer within their budget. Showing a suggested bid amount in the offer flow or within Offer Simulator will guide buyers to submit a competitive offer.

Feature 2:

”SUggested BiD” shows the buyer the suggested $ bid in Offer Simulator with details about the factors affecting the bid.

Budget

Listing price

Offer price

Earnest money

Type of transaction (cash or finance)

Loan approval status (pre-qualified, or pre-approved, or underwritten)

Lender type (Opendoor partner or others)

Contingencies (inspection, appraisal, and existing home sale)

Closing time-frame

Timeline (flexible vs hard deadline for the closing)

Riskiest Assumptions:

Opendoor is able to calculate an accurate suggested offer that does not have a negative impact such as overbidding, loss of trust in Opendoor when the offer is not accepted due to getting outbid because of other factors.

Suggested price will have a greater predictability and accuracy than Zestimate

Suggested price won’t have a negative impact on the number of offers submitted if the suggested offer amount is more than the buyer’s budget or expectations.

Offer Simulator & Suggested Offer would provide more optimal and real-time projections than agents.

The average buyer’s offer-to-acceptance ratio is low.

Success Metrics:

Quantitative: Increase offer acceptance by 20% points.

Qualitative: Offer Simulator & Suggested Offer helped sellers submit a competitive bid.

Qualitative: High NPS survey score of buyers who have used Offer Simulator to make a bid.

Mockup: offer simulator, suggested bid and buy now features with listing page as entry point