What’s Fast?

Fast offers sellers a Fast Checkout button which can be implemented on an e-commerce product page or the shopping cart.

Shoppers with a Fast account can checkout with one click, without having to sign-in again at stores that accept Fast.

The UX feels minimalistic, limiting the number of fields during signup. The shipping address and payment method defaults to the information you enter when signing up for Fast.

Not having options to modify the payment method or shipping address might even pass as a feature and not a gap, though that functionality may get added in the future.

Fast co-founder Allison Barr also highlights not requiring users to fill out forms.

From e-commerce shopping cart to a healthcare provider payment flow, one common friction step is the sign-up and sign-in process required to complete a transaction. What if I could authorize access to my private data, be it payment info or health history, with a single tap?

It makes an argument for Fast being an identity company that does checkout even more intriguing than Fast as checkout company, that also does identity.

It makes an argument for Fast being an identity company that does checkout more intriguing, than Fast as checkout company that also does identity.

Spurred by the scarcity of available product information on Fast, this post aims to understand the problem space, and contextualize Fast's opportunity to evaluate its potential and possible strategies for success.

The Market

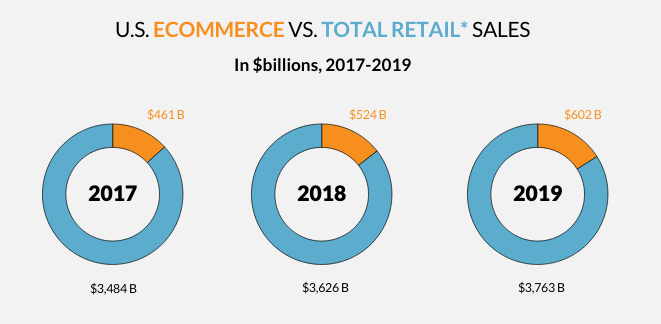

According to research by Digital Commerce, in 2019:

16% or $601 billion of $3.7 trillion retail-spend by U.S. consumers was online. 84% or $3,161 billion was spent in physical stores.

The growth in e-commerce spend versus in-store was the biggest annual percentage point jump since 2000.

E-commerce accounted for more than half—56.9%—of all gains in retail last year — largest share of growth for online spending since 2008.

Adding to the momentum of e-commerce growth is COVID-19, which has confined consumers to their homes, pushing even the most reluctant consumers to shop online.

It’s probably safe to hypothesize that 2020 will go down in history as the year for the highest recorded e-commerce growth, and the lowest ever for in-store spend.

“2020 will go down in history as the highest recorded year for e-commerce growth, and the lowest ever for in-store spend.”

The Problem

A checkout experience begins after a user has added items to their cart and explicitly clicks or taps to ‘checkout’. Consumers face checkout friction any time they have to fill a form to sign-up, sign-in or enter billing information.

A typical e-commerce checkout flow looks like this:

User visits the product page and adds item to cart

User visits cart on multiple devices (75% abandon cart) & clicks check-out (47.5% abandon checkout)

User signs-in or signs-up to checkout OR uses Guest checkout OR uses PayPal

User enters shipping address

User enters credit card & submits payment

“Consumers face checkout friction any time they have to fill a form — to sign-up, sign-in or enter billing information.”

A study by Baymard Institute to understand “reasons for abandonment” found the following reasons given by users for checkout abandonment:

55%: Costs too high (including shipping, taxes etc.)

34%: Site requiring to create an account

26%: Too long or complicated checkout process

21%: Could not see total order cost upfront

17%: Didn’t trust the site with credit card information

Opportunity

The changes in buyer and seller demographics could signal the opportunity for a renewed payments and checkout experience.

Millennials & GenZ:

Today, over 50% of online shoppers are Millenials. However, according to Accenture, GenZ would make up to 40% of US consumers by 2020, describing them as a mobile-native “see now, buy now” segment. Moreover, only 28% of GenZ trust their financial institutions to be fair and honest, making the majority more likely to try non-traditional ways of managing and spending their money.

Accenture further posits “They are likely to be the first generation to forgo the leather wallet for the digital wallet…they will also force traditional players to elevate mobile payments value as a matter of survival…to deliver, the industry must design payments experiences around human needs...delivering a unified mobile payments experience is ground zero in the battle for the consumer”

Direct-to-Consumer:

According to eMarketer, D2C brands will account for $17.75 billion of total ecommerce sales in 2020, up 24.3% from the previous year, while 40% of US internet users expect D2C brands to account for at least 40% of their purchases within the next five years.

A differentiated payment experience that meets the needs of 87.3 million D2C ecommerce buyers could help carve out a niche to win early adopters.

Creators:

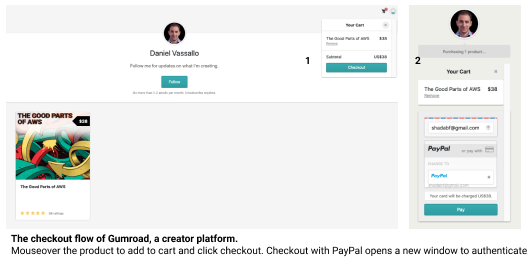

Creators are individuals who sell digital goods and services as one-off transactions or recurring subscriptions through marketplaces such as Patreon and Gumroad. The products are non-traditional, but the checkout flow and payment methods are often modeled after a retail e-commerce checkout flow

A frictionless, one-tap checkout experience could have a meaningful impact on conversion rates for creator marketplaces and data driven creators such as Daniel Vassallo.

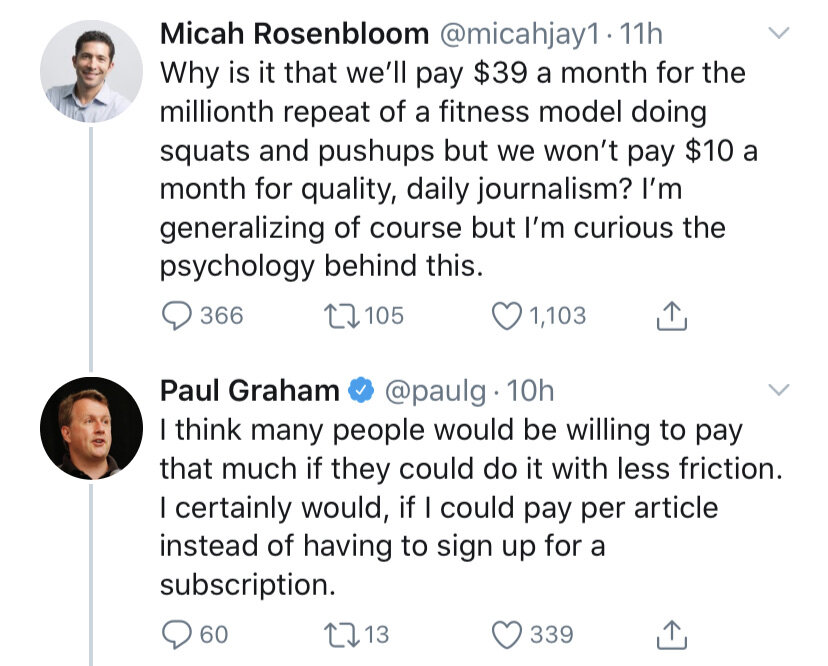

Publishers:

The shopping cart equivalent for a publisher such as the New York Times is the paywall - a pop-up window that requests the user to sign-in or subscribe.

NYT is the global leader in digital subscriptions according to assessments by Statistica. In 2019, it passed $420 million in revenue through its 5 million news subscribers - a new subscriber record.

NYT is experimenting with dynamic paywalls, including bundling, pricing and login/signup elements. However - a big piece of the paywall puzzle to unlock next 5 million users could be a payments experience that feels more native and quick (like Apple Pay but for ALL devices) and less of a process, like the “Checkout with PayPal or Card” flow (see screenshot below).

Conversational Commerce:

Per Wikipedia, conversational commerce is e-commerce done via various means of conversation including live support, online chat, chat-bots and voice assistants.

According to McKinsey, 31% of Chinese WeChat users made a purchase through WeChat in 2016 - double the rate of 2015. China is leading the way with the Chatbot revolution.

After adding a shopping feature to Instagram with a “checkout” & pay option within the app, Facebook launched a catalog feature for WhatsApp, letting users showcase their products along with pricing. Unlike Instagram, the checkout happens outside the app.

A seamless mobile optimized checkout experience for social could open an untapped (no pun intended) shopping channel for the seller.

Update 5/19: Facebook partners with Shopify to launch ‘Shops’, turning every Instagram business profile into a storefront.

Update 12/8: WhatsApp launches shopping cart feature: https://blog.whatsapp.com/making-it-easier-to-shop-on-whatsapp-with-carts/

Charitable Giving:

Charitable giving is 2.1% of the GDP. In 2018, the largest source of US charitable giving came from individuals -- $292.09 billion, or 68% out of the $427.71 billion total charitable giving. The majority of it to the tune of 29% went to religion according to NPTrust.

While 49% of church giving transactions are made with a card, 60% are willing to give to their church digitally according to NPSource. A digital payment experience optimized for the live audience could increase giving while adding convenience for the attendees.

Competitive Landscape

Completing an e-commerce transaction with the lowest amount of effort is a delightful experience. Which is why, any payment processor or a marketplace that has traction with buyers and sellers creates its own “Pay with X” button.

Following is a matrix with payment incumbents who offer the distribution to sellers and convenience of a more seamless checkout to shoppers.

PayPal is the most used alternative payment option, and third most used payment option after debit cards and credit cards used by 305 million users and 22 million merchants.

PayPal‘s One Touch product has 70 million registered users and 6 million merchants as of 2017 (source). It has also integrated Braintree into its onboarding flow to offer sellers payment processing services.

PayPal’s “One Touch” product has 70 million registered users and 6 million merchants as of 2017

Stripe has been used by over 50% of Americans who use it without ever noticing the underlying technology.

It flirted with the idea of a “Pay with Stripe” button, and instead settled on a Stripe hosted checkout experience that allows the shopper to save their billing information that is attached to their email address and phone number.

In future visits to Stripe merchants, a repeat shopper receives an SMS to the phone number attached to the email provided at checkout. The customer can then input that code to checkout without having to re-enter their card information.

One might notice that the “Pay with PayPal” option is missing from Stripe checkout integration, alongside Apple Pay, Google Pay and Microsoft Pay likely because PayPal acquired Braintree in 2013, becoming a direct competitor to Stripe.

Closing Thoughts

PayPal found PMF with the Pay with PayPal button after an eBay user reached out to the PayPal team asking for permission to use the PayPal logo in its auction listing. PayPal challenged the status quo of credit card payments and had to deal with fraud and other operational issues along their journey to product-market fit. (PayPal Wars has a great account of the early days of PayPal).

Stripe’s Collison brothers challenged the status quo of a lengthy, multi-step process to accept credit card payments on the web. With no monthly fees or minimums (free to create an account), Stripe created a paradigm shift by enabling developers to accept payments with a single API call. Stripe also became a case study for developer adoption, helping it achieve a valuation of $36 billion in the most recent round of funding.

“In a great market — a market with lots of real potential customers — the market pulls product out of the startup. Conversely, in a terrible market, you can have the best product in the world and an absolutely killer team, and it doesn’t matter — you’re going to fail.” - Marc Andreessen

Fast is essentially a a two-sided marketplace of buyers who seek a delightful checkout experience, and sellers who want to optimize their conversion rates.

The largest incumbent today is PayPal with over 10 billion transactions in 2019, and a competing product called One Touch. It has recognition and distribution with millions of buyers and sellers.

As Stripe led the Series A investment, it’s possible that Fast could get help by Stripe with merchant adoption, allowing merchants to dynamically display a Fast button to Fast shoppers.

Not having to fill out forms to pay is diffrentiated value that Fast needs to validate with scale — millions of buyers, sellers and transactions.

The initial feedback about Fast checkout from buyers using it on the Fast swag store has been positive. If this positive feedback can scale and Fast continues to innovate in making the payments journey more delightful, it has the potential to become an attractive offering to both the shopper and the merchant.